Our Blogs

Standalone dental and vision plans fill the biggest gaps in Medicare by covering routine care, preventive checkups, and essential treatments that traditional coverage leaves out. These plans bring financial stability, reducing surprise expenses from exams, glasses, crowns, or major procedures by turning unpredictable bills into manageable, planned costs. Better dental and vision care directly support overall health, independence, confidence, and long-term quality of life, making standalone coverage a practical investment for aging well. Most people entering Medicare are surprised by a detail that no one really talks about: the moment you turn 65, you get great medical coverage, yes, but not the full picture. Dental and vision care quietly slip through the cracks, even though they’re some of the most common and essential needs as you age. The result is that many beneficiaries only realize the gap once they need a crown, or new glasses, or a root canal, and suddenly the costs feel like they came out of nowhere. Standalone dental and vision plans fill this gap in a clean, simple way that Medicare by itself cannot. Here is why Medicare beneficiaries should consider standalone dental and vision plans, and what makes these plans genuinely worth exploring. 1) What Traditional Medicare Covers Here’s what you need to know about what Medicare covers and where the gaps begin. a) What Parts A and B Actually Cover Traditional Medicare provides strong medical coverage , but it focuses almost entirely on hospital and medical needs. Part A handles inpatient care, hospital stays, skilled nursing facility care, hospice, and some home health services. Part B covers doctor visits, outpatient care, specialist appointments, preventive screenings, diagnostic tests, durable medical equipment, and medically necessary treatments. It’s comprehensive when it comes to medical events and emergencies, but its coverage stops short the moment you step into anything considered “routine care” for your teeth or eyes, which is exactly where many retirees spend the most out-of-pocket. b) Medicare Leaves Out Most Dental Care Medicare does not treat dental care as medically necessary unless it relates to a larger medical procedure. That means everyday essentials like exams, cleanings, fillings, extractions, dentures, and crowns are not included. For many seniors, a single unexpected dental visit can create a large, unplanned bill that feels completely disconnected from the security Medicare usually provides. Standalone dental coverage brings order and predictability to these costs, turning what would be surprise expenses into manageable, planned care. c) Vision Care Isn’t Fully Covered Either Just like dental care, routine vision services are not part of Medicare’s structure. The program will cover medically connected eye exams for glaucoma, diabetes, or other diagnosed conditions, but it will not pay for standard checkups, glasses, frames, or contact lenses. Even after cataract surgery, certain lenses or upgrades can still come with out-of-pocket costs. A vision plan closes that gap, allowing beneficiaries to keep prescriptions updated and eye health monitored without financial hesitation. d) Medicare’s Gaps Often Lead People to Delay Care When routine dental and vision services aren’t covered, many beneficiaries start postponing checkups or cleanings because the costs feel unnecessary in the moment. But delayed care almost always leads to bigger problems, more decay, worsening gum health, shifting prescriptions, or preventable eye strain. These conditions become harder and more expensive to fix when they’re ignored for too long. Standalone plans help people stay consistent instead of waiting for problems to become urgent, which keeps health stable and costs easier to manage. e) How Supplemental Insurance Fills the Gaps Medicare Doesn’t Cover Many beneficiaries assume Medicare’s coverage is complete, but it leaves major areas uncovered, especially dental and vision. This is where supplemental insurance becomes valuable. These plans are designed to add the benefits Medicare excludes, giving you predictable coverage for routine appointments, larger procedures, and ongoing vision needs. A supplemental plan removes the guesswork around what is paid for and what isn’t, ensuring you always have structured support even when medical and routine care overlap. 2) The Financial Reality Behind Dental & Vision Care After 65

Choosing the right Medicare plan is important to maintaining continued good health. A Licensed Agent or a Licensed Broker can help with your search – but they operate differently. An agent can match you with an appropriate Medicare program, but only those offered by a single insurance provider. That is called a “captive agent.” You may find a program that meets your needs, but your choices are limited to only those offered by that one carrier. A Licensed Broker can provide a choice of programs from a variety of carriers, providing you with more coverage options. A Broker is not tied to one provider’s offerings, so there’s a greater opportunity to find a program more precisely tailored to your medical needs. An independent Insurance Broker can provide you with more choices, more personalized coverage, and the objective guidance you need… all at no cost to you. To take advantage of a year-round, personal guide through the maze of Medicare, call us today.

When is the Medicare Annual Enrollment Period… and why is it important to you? The Medicare Annual Enrollment period runs from October 15th through December 7th each year. The Annual Enrollment Period is only extended beyond December 7th when FEMA declares an emergency or a major disaster in your area that would make sign up difficult. Each September - before the AEP period begins - you’ll receive an Annual Notice of Change letter detailing the changes in your coverage for the following year. Being aware of the Annual Enrollment window is important, because it gives you the opportunity to reevaluate your current coverage and decide whether to change it. Any changes you make during the AEP go into effect on January 1st of the following year. For example, you can switch from Original Medicare to a Medicare Advantage program that may provide additional coverage that Original Medicare does not. You also have the option to switch from one Medicare Advantage program to another for increased benefits. If Original Medicare coverage changes, you can even switch back to Original Medicare, or just update your Part D drug plan to take advantage of price changes in prescription drugs. As you can see, there’s a lot to know about Medicare Annual Enrollment. Let us help you with your important Medicare decisions. Call to speak to a licensed insurance agent.

International travel can be an exciting, memorable introduction to new cultures and foods. But what if you have a medical emergency during your trip? Original Medicare or Medicare Supplemental Insurance will cover very little of the cost - if accepted at all - outside the U.S. Even corporate employer policies may not provide sufficient coverage to meet all your medical needs… or be accepted by a foreign medical facility. Before your next trip, consider purchasing medical travel insurance to supplement your current medical coverage. At The Insurance Office, we’ve partnered with GeoBlue and the Travel Insurance Center, leading providers of international medical travel insurance. An International Medical Travel Policy can provide you the comprehensive coverage you need… and the peace of mind you deserve. Whether you’re a missionary, an ex-pat living overseas, or just enjoying a long overdue vacation, a policy from our Travel Insurance Center gives you access to elite overseas medical care - whenever you need it - from trusted companies like GeoBlue. And with GeoBlue and the Travel Insurance Center’s easy-to-use online portal, you can choose a plan and sign yourself up in minutes. Make sure that your medical coverage travels with you on your next trip out of the country. To find out more about purchasing travel insurance, go to my website and click on the Travel Insurance Center today.

Have you thought about how your passing will affect your family’s financial life? During this time of grief, you want to make sure that loved ones won’t have to worry about paying for your final expenses. Funeral expenses alone can exceed $10,000 in most states and final medical expenses can add thousands more. Final expense or so called “end-of-life” insurance policies can provide you and your family with peace of mind. These “end-of-life” policies cover your final funeral, legal and medical expenses, and they are a type of whole life policy. They offer affordable premiums, fixed interest rates, and can never be terminated due to age. You will have to answer a few – or in some cases no – health questions to qualify and most offer a free “Accelerated Death Benefit Rider” that allows you to access up to 50% of the death benefit while alive. To find out more about final expense insurance, call us today.

To get the most out of your Medicare coverage, it’s important to understand what the different parts of the Medicare program provide and what the cost is to you. The Medicare program consists of three parts: Part A - Hospital Insurance, Part B - Medical Insurance and Part D - Prescription Drug Coverage. Let’s talk about Medicare Part D – Prescription Drug Coverage. Medicare Part D helps you cover the rising cost of prescription drugs after age 65. Premiums may vary depending on what plan you choose and may change each year. You may also have to pay an extra amount each month based on your income, if your adjusted individual gross income from the two years prior exceeds preset earnings limits for filing single or if married filing jointly. Social Security will tell you if you must pay this extra amount to Medicare - not to your plan – and the amount will be adjusted each year based on your most recent IRS return. You might pay a penalty if you don’t join a drug plan when you first join Medicare and go 63 days without coverage similar in value to Part D coverage. Most plans do charge a deductible, and the amount that you pay out-of-pocket before the plan begins to pay, as well as the payment amount, will vary. Your actual costs will also depend on the drugs you take, what drugs the plan covers and the pharmacy. As you can see, there’s a lot to know about Medicare, so why not get some help with your Medicare plan? Call us today to make sure you get the all the benefits from Medicare that you deserve.

What is the Medicare Open Enrollment Period… and what coverage changes can you make? If by Open Enrollment you mean the Medicare Annual Enrollment Period, from October 15th through December 7th each year, you can make changes to your current Medicare Advantage Program or Part D drug plan. However, if you’re already enrolled in a Medicare Advantage Plan, your Open Enrollment window is from January 1 to March 31. During this period, you can switch Medicare Advantage Plans, leave your plan to return to Original Medicare with or without drug coverage, or just change your Medicare Advantage Drug Plan. Finally, there is the Medicare Supplement or Medigap Open Enrollment Period that occurs once in a lifetime, unless you are collecting Social Security Disability Benefits. It begins on your Medicare Part B effective date, usually the first day of the month after you turn 65, and you don’t have to answer any health questions to qualify. Choosing a Medicare Supplement Plan during the Medigap Open Enrollment Period offers you the best chance to find a plan in your area that offers the coverage you need at the lowest cost. After six months, your window of opportunity closes, and you’ll have to answer health questions if you want to apply. Navigating all these different Open Enrollment Periods can be confusing. There are also special circumstances that can affect the SEP timelines - and your eligibility - that your advisor can make you aware of. Let us help you with your important Medicare decisions. Call to speak to a licensed insurance agent.

To get the most out of your Medicare coverage, it’s important to understand what the different parts of the Medicare program provide and what the cost is to you. The Medicare program consists of four parts: Part A - Hospital Insurance, Part B - Medical Insurance, Part C – Medicare Advantage, and Part D - Prescription Drug Coverage. Let’s talk about Medicare Part B - Medical Insurance. Part B covers outpatient care like doctor visits and lab tests. The premium for Part B Medicare is determined by your income. The amount can change each year and you pay this premium monthly, even if you don’t receive any Part B services. You pay a Part B deductible once a year before Medicare begins to pay. Once you’ve met your deductible, you’ll pay 20% of the cost of any Medicare-covered services or items. If you don’t sign up for Part B coverage when you first become eligible for Medicare, usually at age 65, your monthly premium could go up 10% for every 12-month period without Part B coverage. You’ll have to pay this late enrollment penalty each time you pay your premium for as long as you have Part B, and the penalty increases the longer you go without Part B coverage. As you can see, there’s a lot to know about Medicare, so why not get some help with your Medicare plan? Call us today to make sure you get all the benefits from Medicare that you deserve. Not connected to the Federal Medicare Program. This is a solicitation for insurance.

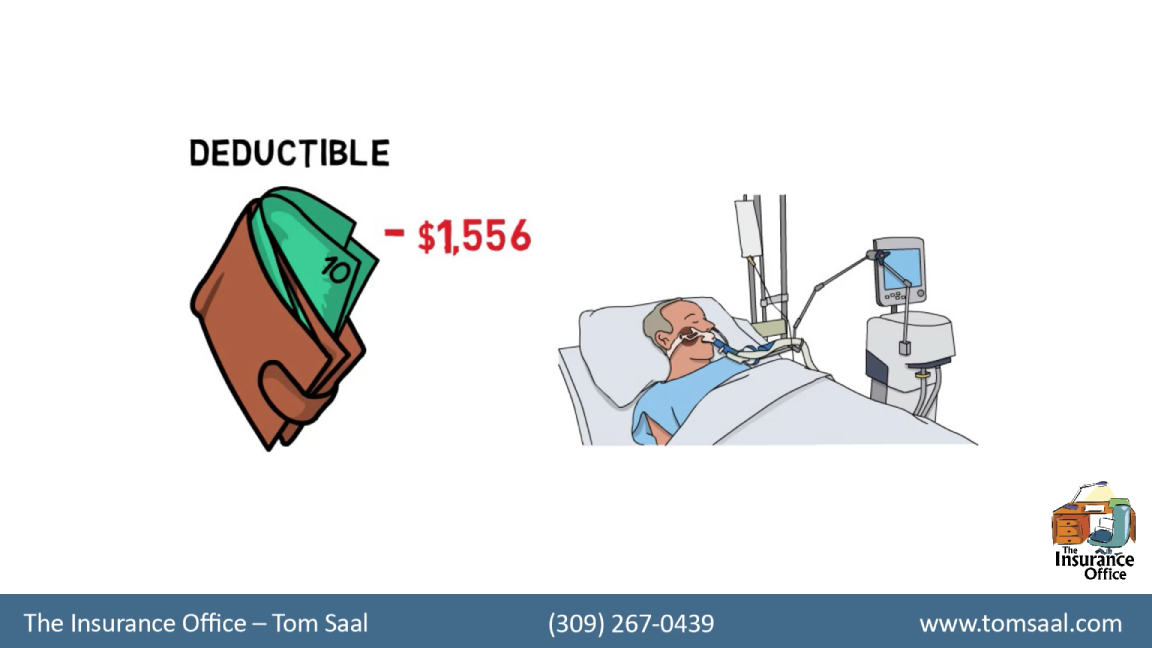

To get the most out of your Medicare coverage, it’s important to understand what the different parts of the Medicare program provide and what the cost is to you. You become eligible for Medicare coverage when you turn 65. If you’re younger and disabled for 24 months or have certain illnesses, you can also qualify. The Medicare program consists of four parts: Part A - Hospital Insurance, Part B - Medical Insurance, Part C – Medicare Advantage, and Part D - Prescription Drug Coverage. Let’s begin with Part A – Hospital Insurance. For most people, you pay no premium for Part A hospital coverage, because you’ve been working at least 10 years and paying Medicare taxes. You pay a deductible each time you’re admitted to the hospital per benefit period before Medicare begins to pay. The benefit period ends after you have received no inpatient treatment for 60 consecutive days. While there is no limit to the number of benefit periods you can have, you must pay the inpatient hospital deductible each time a new benefit period begins. The costs for inpatient hospital stays are calculated this way: For Days 1-60 you pay $0… after you pay your Part A deductible. For Days 61-90 and Days 91-150, you pay an increasing amount for each segment, while using your 60 lifetime reserve days. After day 150 you pay all costs. As you can see, there’s a lot to know about Medicare, so why not get some help with your Medicare plan? Call us today to make sure you get all the benefits from Medicare that you deserve. Not connected to the Federal Medicare Program. This is a solicitation for insurance.