Do I Need Life Insurance? Choosing the Best Insurance for Every Life Stage

You cherish the moments you spend with your family. Every birthday and holiday get-together reminds you of what’s really important in life. These special times are what your family may remember about your life together after you’re gone. So when asking yourself “do I need life insurance,” think about the legacy you want to leave behind. Think about helping to provide your family with financial security for many years to come.

Why Do I Need Life Insurance?

The value you provide to your loved ones can never be replaced. You are the heartbeat of the family who keeps things going. But life can be unpredictable. We all want to live to a ripe old age, but sometimes, we pass on too soon. In the unfortunate event your family will have to go on with life without you, the need to keep a roof over their head won’t end. Bills have to be paid, kids have to go to school, and the dog has to get his vet check-up. When you look at things this way, you realize that you have to protect your family’s financial future. This is where life insurance comes in. It can help your family pay for expenses like a mortgage or your child’s college education.

But there’s more to life insurance than just the death benefit it pays to your beneficiaries. A life insurance policy can also build cash and/or loan value, which means you can get money or borrow from the policy while you’re still alive. This financial tool is available with permanent insurance policies, which provide lifetime insurance or coverage up to a certain age (such as 95 or 100).

When you think about the value that life insurance offers you and your family, it may be easier to answer the question “do I need life insurance?”

But sometimes, it is not this question that stays in your thoughts. It’s the, “I don’t need life insurance because …” that can make you question if you need it. It may be that there are some people who don’t need this coverage after all. But for the ones who do need it, but think they don’t, it can be because of myths they have about life insurance. Getting things straight about these myths may help you better decide if you should get coverage and how to choose life insurance that fits your needs.

Overcoming Common Myths about Getting Life Insurance

According to LIMRA’s 2015 Facts About Life, many people without life insurance agree they need it. Yet, some don’t get it because of common myths they have about purchasing a policy. This article will guide you through these myths so you can make an informed decision about why do you need life insurance. These are some of the most common reasons why people don’t get life insurance:

- It costs too much. This is the number one reason why Americans aren’t purchasing coverage, according to a 2015 study from Life Happens and LIMRA . But the fact is, 80% of people overestimate the cost. Millennials are among the different age groups who think life insurance costs way more than it does. In the study, those under age 25 estimated that a healthy 30-year-old with a $250,000 level term policy would pay $600 a year. This price was about 4 times more than what that plan would really cost, which is about $160 a year.

- I’m single and have no dependents. Unless your family has a lot of money, you may still want to get insurance that could at least cover your funeral expenses . If you have personal debts that someone else could become responsible for after you die, you should consider getting a policy.

- Only the breadwinner needs insurance; my stay-at-home spouse doesn’t. Some may agree that a stay-at-home spouse works more than 40 hours a week. With all the cooking, cleaning, grocery shopping, plus traveling to doctor’s appointments and putting bandages on cuts if you have kids, the value that a stay-at-home spouse makes may be priceless. But what would happen if the homemaker in the family dies? How would the million and one things he or she does be paid for? Money from a life insurance policy on a homemaker could help cover the new expenses that the homemaker previously provided (free of charge) when he or she was alive.

- I get insurance through my job. The average life insurance policy from a job pays $50,000 if the employee dies, according to Time Magazine . That amount may not be enough to replace your income if you have a spouse, children, or debts. However, Investopedia notes that if no one depends on you for income and you live a modest lifestyle, a workplace plan may be enough for you.

- I’m young and healthy, so I don’t need to worry about dying. If this describes you, you may be thinking, “why do I need life insurance?” But when it comes to life coverage, waiting until your health starts to get worse is not the best time to seek coverage. Young people in good health usually pay less for insurance. Plus, poor health and old age are not the only things that could lead to your death. In fact, motor vehicle accidents are the primary cause of death in the U.S.—and other accidental injuries like falls and murders are also some of the leading causes of death for people under age 44, according to the Centers for Disease Control (CDC) and Prevention .

- I’m not healthy enough. Poor health is not an automatic denial for coverage. With certain types of life insurance, you can get a policy without taking a medical exam (these are known as simplified issue policies). These policies usually come at a higher cost, but can still provide you with insurance protection nonetheless. There are also several insurance companies that provide policies for certain health conditions . According to the 2012 LifeJacket Study from Genworth, common conditions for which people can get life insurance include hypertension, high cholesterol, sleep apnea, obesity, asthma, anxiety, and depression.

- I have plenty of assets that can support my family’s needs. The value of your assets may be enough to financially support your family for several years. But if you were to die suddenly, your “assets may not be easily transferred into cash,” as noted by published author and CEO, Wm. Scott Page, in a Huffington Post article . Mr. Page also writes that wealthy individuals with a lot of assets get life insurance for three main reasons:

- Liquidity, which is how fast you can get cash from an asset

- Income replacement

- Wealth transfer

If your assets are part of a business, and you want to leave your business to your survivors, they would need to know how to run your company to get long-term income from it. If you’re married and run a construction company, for example, would your surviving spouse be able to continue the family business? If you have adult children, do they have the skills or even the interest to carry on the company you’ve worked hard to build? What about if you have young children? Is it likely that your company would last long enough for them to take over ownership when they grow up? With these things in mind, having assets may be an unsuitable reason to not get life insurance.

Life Insurance That Fits Your Needs

Sometimes, it’s not the “why do I need life insurance?” that is difficult to answer. It’s the “how do I choose the right life insurance plan?” that can make thinking about insurance seem over your head. This is why insurance agents like me are here. We’re here to help you understand the basics about life insurance so you can decide what’s right for you. To get you started, let’s discuss different types of life products and who they may be a good fit for.

Tips on How to Choose the Right Insurance

- Know your needs—do you only want to cover your burial costs or provide your family with replacement income to pay for long-term living expenses?

- Understand insurance types—do you only need insurance for a specific number of years or for a lifetime?

- Know what factors determine the costs—age, personal health, family health history, gender, smoking habits, lifestyle, and occupation

- Compare different rates to make sure you’re getting a policy you can afford

- Get in touch with me to talk about your unique needs

When Choosing Term Life Insurance May Be Best

When you’re faced with the question, “do I need life insurance,” term life insurance can be a good place to start. A term plan is a simple type of life insurance because its only purpose is to pay out a death benefit to your beneficiary if you die during the term of the policy. It’s also one of the most affordable life insurance options available. Another bonus with term insurance is that most policies can be set up to switch to permanent coverage when the term ends. So if you’re on a budget, you can get a lower-cost policy now without worrying about losing coverage later in life.

You typically need to take a medical exam to get a term plan—doing this could save you money on premiums if you’re in good health. The other option is to skip the medical exam by going with a simplified issue policy that only requires answering a few health questions—the downside is you will likely pay more on premiums.

Unlike permanent insurance, term policies last for a specific time frame. You can get coverage for one year at a time (called annual renewable term), which may work for you if you’re unsure about how long you need insurance, but these plans are very rarely offered. There are other term life insurance types that provide longer coverage, usually from 5 to 30 years.

Although most can enroll in a term plan up to a certain age (usually 70 or 80 ), this type of coverage may be better for certain groups of people:

Let’s look at when is life insurance necessary as it relates to term insurance.

You’re young and married with kids. According to USA Today, term life insurance can be a good fit for young families. Having a young family is usually the time when you need the most life insurance, as mentioned in a recent article from ConsumerReports. This is because it would take a larger death benefit to replace the loss of your income after you’re gone.

If you have a 5-year-old for example, you’re probably looking at another 20 years of care until your child starts earning enough money to make it on their own. If you were to die before your kids grow up, your family would need a lot of money to cover major expenses like a mortgage or college education. Even if both you and your spouse work, it may be hard to get by on one income. If one of you stays home to take care of the kids, and he or she dies, that’s an extra expense to pay for child care services.

Also keep in mind that child care often costs more for younger children. And your budget may already be tight after paying for things like your rent or mortgage, car note, gas, and credit card debt. With all these expenses, a term plan offers the opportunity to get the most coverage at a cost that won’t break the bank.

You may be wondering how much coverage you should get when purchasing life insurance. The exact amount that would be right for your needs can only be determined by a licensed insurance agent. But for example, if you need $20,000 a year for more than 20 years, buying a $500,000 policy may work for you. You can also use this life insurance calculator from Bankrate to roughly estimate how much insurance you may need.

You’re married with no kids. Even without little ones running about, you may still need replacement income if one of you dies. Many Americans rely on two incomes to survive, so you may not be able to maintain the same living standard on just one. You may also be thinking about having kids soon. Some insurance companies don’t issue policies to pregnant women —so before you have children, and while you’re younger, may be a better time to get a policy.

According to Bankrate , term insurance can be a good fit for married couples without children because of its economic value. If you’re in your 20s or 30s, for example, both you and your spouse could buy a 30-year term policy that converts to permanent coverage. A policy like this could replace your income and build cash value you could use in your retirement years.

You’re a single-parent. Being a single-parent isn’t easy, especially when it comes to finances. Even if you get child support, it may not be enough to replace your income after you’re gone. So if you’re a single-parent thinking “do I need life insurance,” the answer is yes.

A term plan is usually the cheapest option for single-parents, according to a report from ABC News. A 20-year term policy for a healthy 33-year-old female valued at $500,000 could cost $240 a year . When divided by 12 months in a year, this works out to $20 a month. If you died before your children become adults, the policy could help pay for their expenses up until or through the college years. If naming your child as the beneficiary, it’s advisable that you also name an adult who will be responsible for the funds. If not, it can be expensive for the court to appoint someone. One way you can avoid the courts getting involved is to set up a custodianship.

You’re single with no children, but have other dependents. There are times when singles with no children have to support someone else. This can include taking care of a younger sibling, relative, or parent. Term insurance can be a suitable choice because it’s designed for short-term needs. The kids you’re raising will grow up and starting making their own income and your parent, though unfortunate, may not live for very long.

When it comes to choosing a life policy, there are different ways you can go about it. You could get a policy on yourself and make another adult the beneficiary, or you can take out a policy on your parent and name yourself as the beneficiary. If you get a policy on your parent, the death benefit you receive can help pay for debts like medical bills or a mortgage left behind. You may need to show the insurance company proof that you will suffer some type of financial loss upon your parent’s death to get a policy.

You’re young and single with no dependents. If you’re a young, single person with no dependents, you may be thinking, “why do I need life insurance?” Although most singles don’t need life insurance, having it can benefit your family. As a young single who may have graduated college or are trying to build your credit, there may be times someone, like a parent, had to cosign on a loan for you. This can include student or car loans.

If you were to die, that person would become responsible for those debts. And if your family lives on a modest income, it may be a burden to cover your funeral expenses plus those debts. Investopedia recommends purchasing an inexpensive life insurance policy that can cover your final expenses. Term insurance can be a good fit since it’s usually more affordable for younger folks.

Life Insurance After 50

Typically, both term and permanent insurance can be suitable for people over 50. But depending on the age range, one may be more preferable. An important thing to take note of is that buying life insurance after 50 generally cost more. Term insurance premiums for people over age 50 can become more and more expensive over time, according to a CBS News article . Although, if you’re past this age and getting a permanent plan for the first time, it may not come cheap.

Tips on Getting Lower Life Insurance Rates

- Work on your health—exercise more, quit smoking, consume less alcohol, etc.

- Don’t put off getting a policy—age is often the most important factor in cost

- Consider if you want to stop any risky hobbies—skydiving, scuba-diving, rock climbing, etc.

- Let the insurance company know if you’ve retired from a hazardous job like mining, deep-sea fishing, or roofing

A type of permanent insurance that may be cost-effective in the long run is whole life insurance. This is because premiums stay the same for the entire policy. With this policy however, it usually takes 8 to 10 years to build cash value, according to Kiplinger Magazine . There are other types of permanent life insurance, such as universal life and variable life. You can find out which insurance would suit you best from a licensed insurance agent.

If you’re still thinking “do I need life insurance if I’m over 50,” here are some things to consider that could help you make that decision:

- Do you have enough money in retirement savings that can meet your living expenses for the rest of your life?

- After you’re gone, can your savings cover the living expenses for those you leave behind?

- Do you still have major debts to pay off?

These questions may be more of a concern if your kids have recently left home or if you’re already retired.

Let’s look at these categories to learn more about who needs life insurance.

You’re a recent empty-nester. Although the kids are out of the nest, there may still be a mortgage to pay off or a spouse that depends on your income. You may even have an elderly parent or a disabled adult child that relies on you for financial support. If you’re saving for retirement, you may not be able to withdraw any funds until a certain age, usually 65. During this stage in your life, it may be a little hard to figure out what type of life insurance you should get.

- Choosing term insurance: according to a Fox Business article, getting term insurance in your 50s or 60s, can still be an economical choice; although, it’s more ideal to get it in your 50s. This is also a good time to get a term plan that converts to permanent coverage because insurance companies usually only let you to do this before you turn 65.

- Choosing permanent insurance: if you want to get permanent insurance because of the cash value, consider this: men and women live up to about 79 years on average. Since it could take up to 10 years to start earning cash value if you have a whole life policy, getting this coverage in your 50s gives you more time to live long enough to reap the benefits. In a Bankrate article , fee-only financial consultant Glenn Daily mentions that there are other options those in their 50s can consider. One option is to do without term coverage and get more insurance with a universal life policy, which provides more flexible premiums. The advantage with this type of insurance is you can adjust the benefit amount to make your premium lower.

- Combining both term and permanent insurance: in the same article, Daily suggests that another option for those over 50 is to get a modest universal life policy and add a term life rider. The potential benefit in doing this is you would have insurance to cover your income if you were to die, and also have a policy that builds cash value you could use to supplement your retirement income.

You’re a retiree. You may be thinking, “if I already have enough retirement savings and assets to support me throughout my life, do I need life insurance?” Typically no. This is because life insurance is meant to end at retirement if you’ve done proper financial planning. But, there are situations when getting life insurance as a senior citizen may be to your benefit. For example, if you have large estates that are not easily liquidated, a life policy could help with estate taxes.

If you don’t have enough money for retirement, you may need life insurance to provide a death benefit if your spouse outlives you, especially if there are not enough savings or pension benefits that your widowed spouse can use to meet living expenses.

- Choosing term insurance: if you’re still in your 60s, term insurance can be suitable. Keep in mind that 80-years-old is usually the maximum age to get this type of coverage. So you may want to get a plan with a shorter term, such as a 5, 10, or 15 years. Kiplinger Magazine recommends that retirees can get a term plan that converts to permanent life insurance. But since converting a term policy to permanent insurance typically stops at age 65 , there’s a chance you may not be able to get a term policy that has this conversion feature. If you’re age 60, for example, you may be able to get a 5-year term plan that can convert to a permanent plan when the policy ends. You should check with the insurance company to determine if they offer policy conversion beyond age 65.

- When you need life insurance that provides permanent coverage: according to Kiplinger Magazine, if your pension doesn’t provide a death benefit for your surviving spouse, you have a special-needs child who requires life-long care, or you want to provide an asset that can be liquidated as cash your heirs could use to buy a stake in a business, you may need insurance that covers you for your entire life. Another reason you may want to get a permanent policy is to leave a legacy for your children, grandchildren, or a charity.

- Getting burial insurance: burial insurance, also called final expense insurance, is usually a whole life policy that provides a death benefit ranging from $5,000 to $25,000, according to the Insurance Information Institute . The Institute also mentions that this policy can be set up to help cover your burial and funeral expenses, as well as for the whole family. A medical exam is usually not required for these types of policies—you would just answer a few health questions on the policy application. Burial insurance can be a good way to help make sure your family won’t have a financial burden to pay for your final expenses and any debt you may leave behind.

Life Insurance as a Business Owner

Are you asking “do I need life insurance as a business owner?” The answer may be yes. Just as you would get life insurance to help make sure your loved ones will be taken care of financially after your gone, you may also need life insurance to keep your business going in the event, you, a business partner, or a key employee were to die. You could get a policy that has both your spouse and a business partner as the beneficiaries, with each getting a predetermined percentage of the death benefit . Or, you could get a separate policy where the business partner is the only beneficiary.

Whichever way you choose, your family can get their own death benefit payout to replace your income, and your business partner can get the money needed to buy out your interests in the company or to buy out your heirs. This is called a buy sell-agreement, and the price that partners would pay for your interests is pre-arranged. This would also apply to your partners where they get a policy that has you as the beneficiary.

You could also get a life policy on a key employee, so that in the event that person dies, your company has the cash flow to keep the business going until a replacement is found.

- Choosing term insurance: term coverage can be a cheaper option, and is best if you plan to run the business for a certain period of time, or if there is a specific date in the near future that you, a partner, or key employee will retire. There can be an agreement that if either partner dies before retirement, the other will buy out the interests of the deceased. Or if a key employee dies, then the death benefit could supplement the loss in earnings the employee brought into your company or to cover the salary of a replacement.

- Choosing permanent insurance: if you, a co-owner, or a key employee plan to run the business for a lifetime, permanent insurance may be a better choice. Although it could be more expensive, you wouldn’t have the risk of a partner or key employee outliving the policy if you were to choose term coverage.

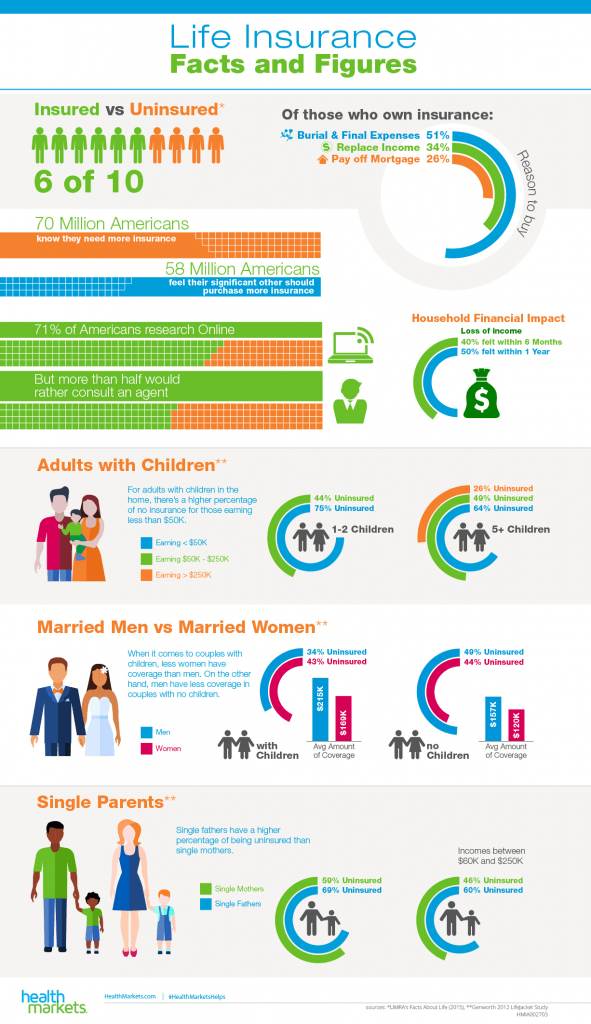

Life Insurance Facts and Figures

Most Americans have insurance. But there are still many who are either uninsured or don’t have enough coverage. Seeing these facts and figures may help show you where you fit within certain demographics.

Make Sure to Consult an Agent

This article can be used as a starting point to answer your question, “do I need life insurance?” It shouldn’t be used as a replacement for consulting a licensed insurance agent. You may have specific needs that are not mentioned in this article. I can help you figure out when life insurance is necessary for you and what type of life policy would most fit your needs. Just give me a call.

HMIA002703